Introduction

Introduction

As your wealth grows, so does the need to acquire comprehensive wealth management. Your financial plan should address every aspect of your financial and life plans/goals, especially if you have a complex financial situation.

The high-level guidelines on this page can be used when searching for the right team of financial professionals to develop and manage a comprehensive wealth management plan for you.

It is imperative to consider the entirety of your financial life when devising a plan. Your assets, income, liabilities, taxes, and business often interrelate, so having a plan that outlines all of these components is critical to ensure there is an action plan for all aspects of your financial situation. Personalized advice and services from a well-established wealth firm can help ensure you have an actionable plan in place to meet your personal and wealth goals.

Setting the Stage for Your Financial Future

Our services are unique in that we do not offer cookie-cutter portfolios. Every client has a specific wealth plan and portfolio for their situation. This allows us to offer truly custom solutions to better serve our clients' needs.

Aspiring professionals and retiring CEOs – a genuine fiduciary relationship sets the stage to reach your short-term goals and to have long-term success.

Widows/widowers and divorcees – someone to lean on for financial stability is helpful in times of need. When coping with grief, the last thing you should worry about is your financial health.

Business owners, doctors, and lawyers – time is money, and your talents need to be dedicated to your field of work.

Young families and individuals approaching substantial wealth – long-term financial planning is the forte of investment advisors. Trust that we build your portfolio with your whole family in mind.

You’ve worked hard to get where you are. Let us help you protect and grow that legacy.

Chapter 1: Why Do High-Net-Worth Investors Need Comprehensive Wealth Management?

Investing is extremely complex. If you do not possess the background to research, analyze, and make ongoing reallocations of your assets, consider hiring a team of financial professionals to oversee your nest egg.

As an affluent investor, you should look for the following qualities in a wealth management team:

- Earns your trust as a fiduciary

- Reduces your stress and worry

- Creates a wealth/financial plan based on your goals

- Helps you manage taxes

- Teaches you how to navigate volatile markets and inflation

- Keeps you informed of economic trends

- Helps you understand your portfolio performance with performance reports

- Supports multiple generations

- Has a highly credentialed team of professionals

With well-defined expectations with your advisory team, this professional relationship can last a lifetime. As an affluent individual, you and your family should look for a team of financial professionals in Marin County who focus on providing you with the highest level of custom care and service.

Having a team in place with the expertise and experience to work through these complexities is necessary.

At Fairview Capital, we have the infrastructure in place to research, manage, analyze, track, adapt, and report on your wealth. We manage more than $1.6 billion in assets for individuals, families, trusts, and institutional investors.

Read: 8 Components of a Comprehensive Wealth Management Plan for Affluent Investors

Chapter 2: How To Find the Right Financial Planner in the San Francisco Bay Area

Do you rely on research as much as we do?

Conducting your own due diligence on the financial advisory team you’re going to hire to oversee your financial life is imperative. You should be prepared to ask a series of objective, fact-based questions that a financial advisory team can respond to in writing.

Making an important decision such as this should not be solely based on personalities. You’re hiring a financial advisory firm’s competence and ability to meet your financial goals. Transparency and experience should be top priorities when interviewing wealth management teams.

Does the financial firm work with investors like you?

When interviewing a wealth manager in Marin County, ask these detailed questions:

- Are the majority of your clients affluent individuals like me?

- What is your minimum asset requirement?

- What are your qualifications, and are you a fiduciary?

- How long have you been a wealth manager?

- How long do your clients stay with you on average?

- How do you get paid, and can you provide transparent fees in writing?

- What are my all-in costs?

- How will our relationship work?

- What's your investment philosophy or methodology?

- How will my assets be allocated?

- What investment benchmarks do you use?

- Do you work with family members and other professionals to support the communication process?

Since transparency and experience equate to trust over time, the wealth manager you choose should be able to:

- Act in your best interests when offering personalized financial advice (fulfilling their fiduciary responsibility)

- Coordinate a team of experienced experts to provide the full range of services required to meet your needs

- Work with your attorneys, accountants, and other professionals

- Employ strategies that reflect your financial goals and risk tolerance

Create a comprehensive plan that incorporates all elements of your financial life

A trusted client-advisor relationship begins with transparent communication. You should always know where you stand financially, so having an open line of communication with your wealth management team is very important.

Fairview Capital does all of these things, ensuring full transparency in every endeavor through consistent communication.

Read: How to Find an Ethical, Fiduciary Wealth Manager in the Bay Area

Chapter 3: Why Fairview Capital Invests in Expert In-house Investment Research vs. Outsourcing

While many wealth management firms outsource their investment research and investing to third parties, we take a different approach, providing you with a more robust and personalized investment strategy.

Our in-house team handles both investment research as well as investing. This allows us to customize and better control how your portfolio is managed, and we can respond to changing market conditions faster.

By handling these key investment processes in-house, Fairview:

- Maintains control and oversight of your portfolio

- Reduces your aggregate management fees

- Manages any tax implications

- Tracks gains/harvests losses

The Fairview Capital investment research team delivers a diligent and disciplined process. The Director of Research and our accomplished team of in-house analysts focus on actively monitoring your portfolio holdings to make sound investment decisions.

Chapter 4: The Importance of Tax-Efficient Investing in Marin County

We are tax-sensitive from the moment we start to manage your accounts.

Understanding your financial situation includes a complete assessment of any tax considerations that should be built into your investment plan. Your comprehensive wealth management plan should carefully consider all tax-related consequences that may come into play when circumstances change.

Your wealth management plan should incorporate details that address both your taxable income and investments as well as your tax-deferred investments, such as your IRA, 401k, Roth IRA, etc.

At Fairview, we consider our clients’ tax bracket, philanthropic commitments, and capital gains or losses from other assets. We will start our relationship with you by analyzing your existing holdings.

“We always take tax implications into account whenever making a purchase, sale, and rebalancing decisions.”

Read: How A Financial Advisor Can Help You Manage Your Tax Exposure

Chapter 5: A Multi-generational Approach to Retirement and Estate Planning

One thing that’s constant is that life changes quickly. Given ongoing changes to your family’s dynamics, your financial advisor team should keep your financial plan and your estate plan up to date. A financial plan should not be done once and then forgotten.

We serve the entire family, acting as your financial advisor, educator, and trusted partner.

We serve the entire family, acting as your financial advisor, educator, and trusted partner.

Your financial team can help you build a financial legacy roadmap designed to preserve your wealth that transfers from generation to generation.

Your wealth team should be committed to working with multiple family members, as appropriate, to ensure a smooth transition across generations. You need a strong communicator when dealing with family members. From investing an inheritance, analyzing tax strategies, or advising on real estate investments, you want a team that will provide guidance and education to your family over time.

Your wealth team should also be able to serve as the coordination point between your estate attorney, accountants, trustees and/or philanthropic advisors, as needed.

Nothing takes precedence over collaborative family communication.

Read: Retirement Planning Guidance From A Wealth Manager In Marin County

Chapter 6: Personalized Portfolios Are Essential to Successful Long-Term Asset Management

Your portfolio is as unique as you.

Understanding your timeline and goals enables your trusted financial partner to invest your portfolio appropriately with the right mix of equities, fixed income, alternative investments, and cash. A long-term investment horizon allows for tax efficiency so your assets can grow with fewer interruptions over time.

Online tools like client portals help you to readily access your accounts. Make sure any Bay Area comprehensive financial planning firm you interview provides an up-to-date platform where you can access real-time data.

Can they show you examples of how performance data will be delivered?

Our investment decisions are based on rigorous research.

Our investment decisions are based on rigorous research.

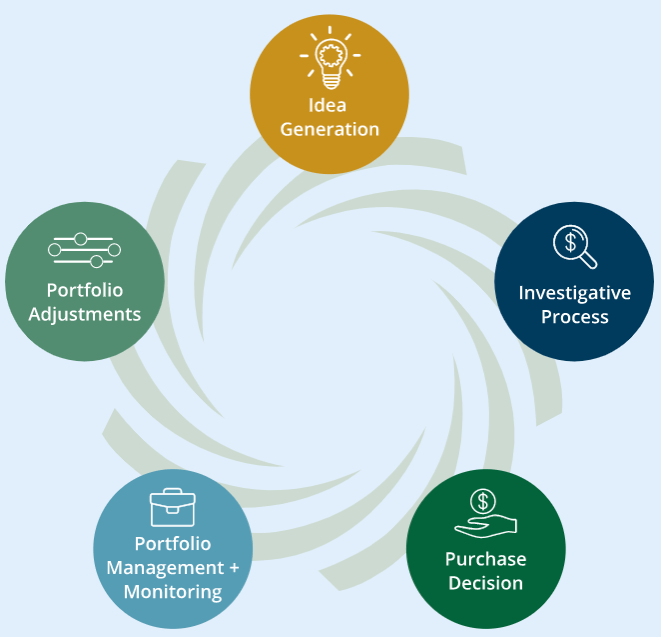

At Fairview, we deploy a five-step in-house research process:

- Idea Generation

- Investigative Process

- Purchase Decision

- Portfolio Management + Monitoring

- Portfolio Adjustments

Advice on external holdings

Ask firms how they handle external investments, such as real estate holdings or limited partnerships. Will they advise you on how to best handle such assets without an additional charge?

Fairview’s team will consider external holdings in your financial planning and strategy.

Regular reviews and consistent monitoring

Consistently reviewing your portfolio allows for close monitoring. You should stay well-informed, whether via video conference, phone check-ins, or email. Your financial advisor team should be readily available to you at all times.

Your financial advisor should always have your best interests in mind. Some goals to discuss with your wealth management team may be:

- Preserving your principal with the right level of risk

- Adjusting investment strategies to deal with inflation

- Growing your principal during your working years

- Minimizing your risk exposure with diversification across asset classes, investment strategies/styles, and individual securities

- Reaching your long-term goals

Personalized asset allocation is the lifeline of financial health.

Read: Fairview’s Personalized Stock Portfolios Can Enhance Your Net Worth

Chapter 7: How High Earners Can Get Started with Investment Management

Research shows that most of today's wealthy individuals were not born into it. Self-made millionaires have practices to build wealth through these actions or characteristics:

- Hire the best to manage their wealth

- Have mentors or advisors

- Set ambitious goals and act on them

- Look for feedback

- Are not afraid of failure

- Understand the value of time

- Know the importance of diversification

- Have multiple streams of income

- Invest in different places and avenues

- Maintain a balanced portfolio

A solid investment philosophy is a foundation for your short and long-term financial success. When you’re getting started on your investment journey, you want to work with a financial advisory team that will help you:

A solid investment philosophy is a foundation for your short and long-term financial success. When you’re getting started on your investment journey, you want to work with a financial advisory team that will help you:

- Understand your short and long-term goals

- Review your current investments (personal, retirement, employee benefits)

- Determine short-term goals such as purchasing a home, investing in education funds for children, etc.

- Set long-term goals such as when you want to retire

Your financial planning team will develop a plan specific to all of your needs. It should also include an outline for how to get to your goals which involves your risk tolerance, investment strategies, tax strategies, and more.

In Summary

When you select a wealth management firm in Marin County, you are hiring a team that can impact the quality of your financial future for years to come.

When you partner with Fairview Capital, you get the power of our experienced, credentialed team. Our personalized wealth planning advice turns highly complex financial situations into robust, easy-to-understand financial plans and investment strategies that encompass all aspects of your life: retirement planning, tax planning, estate planning, insurance, and beyond.

We simplify every process with full transparency.

Handing over the complexities of managing your wealth to an experienced team can save you valuable time and money. Ensure the Bay Area firm you select is worthy of managing both.

The information contained in this communication is provided for general purposes only, and was prepared in reliance on independent, third-party sources that Fairview Capital Investment Management, LLC (“Fairview Capital”), an SEC-registered investment adviser, believes are reliable. Nevertheless, Fairview Capital does not guarantee its accuracy or timeliness of any information provided herein. The information reflects subjective judgments, assumptions and Fairview Capital’s opinion on the date made and may change without notice; Fairview Capital is not obligated to update this information. Nothing in this communication should be construed as investment or tax advice, a solicitation, offer, or recommendation, to buy or sell any security. Investment management services are offered only pursuant to a written investment management agreement, which investors are urged to carefully read and consider in determining whether such agreement is suitable for their individual needs and circumstances. The information in this communication should not be construed as an endorsement, recommendation or sponsorship of any company or security. If this post mentions a specific investment or security, we or our affiliates may have a position in that security (either long or short), and we may profit from a price change in that security.

Investment management and advisory services–which are not FDIC insured–are provided by Fairview Capital. Any links provided to other sites are offered as a matter of convenience and are not intended to imply that Fairview Capital or its affiliates endorses, sponsors, promotes and/or is affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise. All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Please see Fairview Capital’s Form ADV Part 2A and Form CRS for important details.